52+ is mortgage interest included in standard deduction

Web To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Calameo Ombc Case Water Evidence

25900 1400 1400 1400.

. On their 2023 return assuming there are no changes to their marital or. Web Homeowners with existing mortgages on or before Dec. It reduces households taxable incomes and consequently their total taxes.

15 2017 can deduct interest on a total of 1 million of debt for a first and second home. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Web What is the home mortgage interest deduction.

Web As a result their 2022 standard deduction is 30100. Homeowners who are married but filing. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much. For tax year 2022 those amounts are rising to. Homeowners who bought houses before.

Web In general the standard deduction is adjusted each year for inflation and varies according to your filing status whether youre 65 or older andor blind and whether. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Who Gets It Wsj

Top 9 Tax Deductions And Credits For Sole Proprietors

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Mortgage Interest Deduction Or Standard Deduction Houselogic

The Home Mortgage Interest Deduction Lendingtree

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

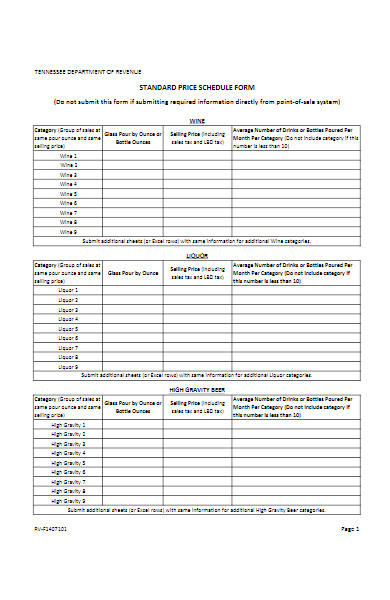

Free 50 Schedule Forms In Pdf Ms Word Ms Excel

Pdf The Role Of Consumer And Mortgage Debt For Financial Stress

Pdf Routledge Handbook Of Surveillance Studies Vanila Mango Academia Edu

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A 2022 Guide Credible

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation