401k payroll deduction calculator

Choose the appropriate calculator below to compare saving in a 401k account vs. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999.

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Ad Compare This Years Top 5 Free Payroll Software.

. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. Homes purchased after Dec. Get Your Quote Today with SurePayroll.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. Ad Compare This Years Top 5 Free Payroll Software. All Services Backed by Tax Guarantee.

The tire diameter calculator exactly as you see it above is 100 free for you to use. Payroll calculator tools to help with personal salary retirement and investment calculations. Specific examples of each type of payroll deduction include.

Our calculator even works with fractions of percentages. If you see an item with an original price of 2499 and the discount is 175 percent you can plug all of those numbers into our. For example say youre a single taxpayer earning a salary of 51200.

Ad Get Started Today with 2 Months Free. Both allow you to contribute regularly to the plan via payroll. The salary calculator exactly as you see it above is 100 free for you to use.

Add earning and deduction items tips 401kPOP child. You have no pretax withdrawals such as a 401k or above-the-line adjustments to reduce your adjusted. Enter the Number of Hours.

The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. Pre-tax Deduction Rate Annual Max. Use this simple 401k calculator to see how much your 401k will contribute towards your retirement to help you save.

Free Unbiased Reviews Top Picks. Enter the Hourly Wage Amount. As an example we will enter 100000 as the.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. There are a number of different payroll deductions that can be deducted from an employees paycheck each pay period. The calculator has a drop-down menu that provides an option to enter either the hours worked per week or per month.

So what makes Californias payroll system different from the systems. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Your household income location filing status and number of personal.

Handles payroll deductions that. The deck stain calculator exactly as you see it above is 100 free for you to use. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement.

Calculator to determine cost. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Payroll So Easy You Can Set It Up Run It Yourself.

A standard deduction can be used. Our software comes with a built-in payroll and paycheck calculator for federal withholding and state withholding for all 50 states and District of Columbia. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for.

A standard deduction is a deduction that is a specific dollar amount that reduces your taxable income. Medical and dental benefits 401k retirement. The FICA tax came about as part of the Federal Insurance Contributions Act FICA and essentially represents the payroll tax that is levied by the United States Federal government on.

Payroll 401k and tax calculators. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Software needs. Discover The Answers You Need Here.

These range from FICA taxes contributions to a retirement or. For tax year 2021 the standard deduction is 12550. Deduction for mortgage interest paid.

Free Unbiased Reviews Top Picks. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. The dividend yield calculator exactly as you see it above is 100 free for you to use.

Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt.

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Pay Calculator Love Calculator 401k Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Explore Our Image Of Employee Payroll Ledger Template Payroll Template Budget Template Payroll

1

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

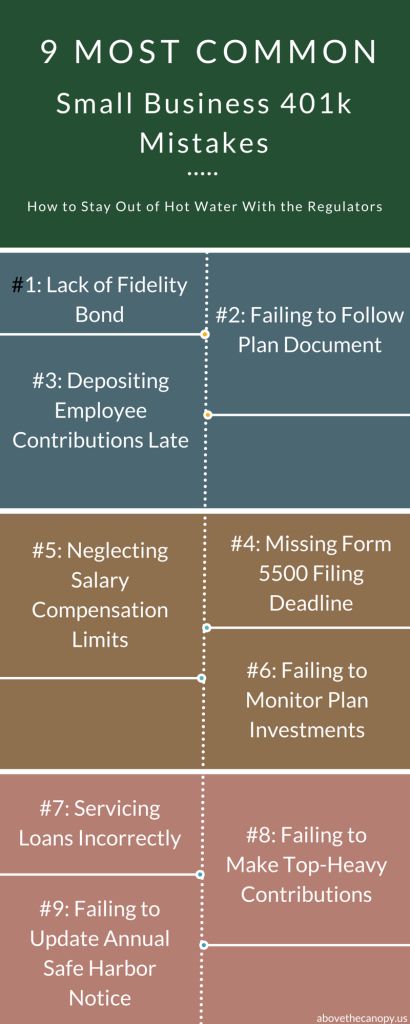

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Pin On Dmm Daily Money Manager

10 Free Payroll Check Templates Ms Word Excel Pdf Samples Payroll Checks Payroll Template Payroll

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Check Stubs Paycheck Employee Handbook Employee Handbook Template